Saving DeFi Saver with Static Contract Analysis

By the Dedaub team

A little after midnight on Jan.5, we contacted the DeFi Saver team with news of a critical vulnerability we discovered in one of their deployed smart contracts and that we had just managed to (offline-)exploit. They responded immediately and we got on a channel with several DeFi Saver people within 5 minutes. Less than 20 hours later, client funds have been migrated to safety via a white-hack exploit.

There were some interesting elements in this vulnerability.

- It affected major clients of the service. We initially demonstrated by exploiting one client for $1.2M. Another client had $2.2M exploitable and several more had smaller positions. There were over 200 clients that had deposited money in the vulnerable service within the past two months so the overall exploit potential was possibly even higher at different times.

- The vulnerability was originally flagged by a sophisticated static analysis, not by human inspection. This is rare. Automated analyses typically yield low-value warnings in monetary terms. We have submitted (back in Nov.) a technical paper on the analysis techniques.

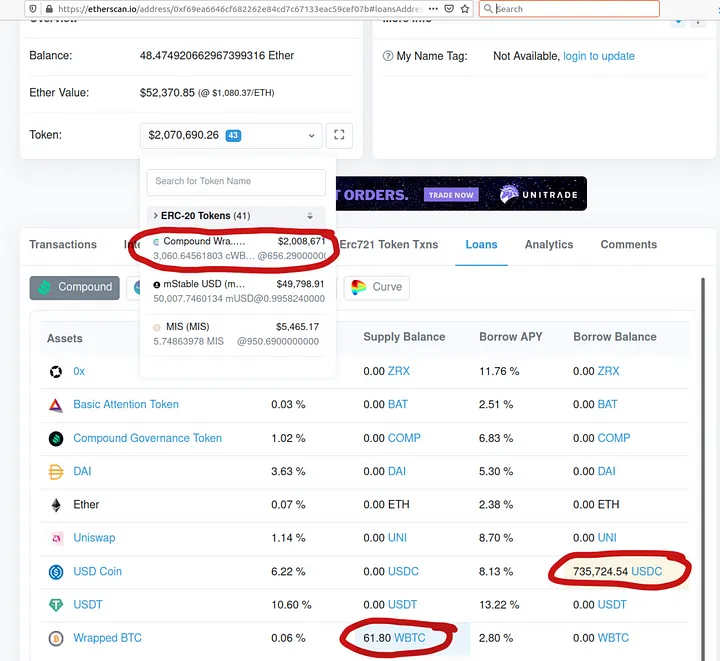

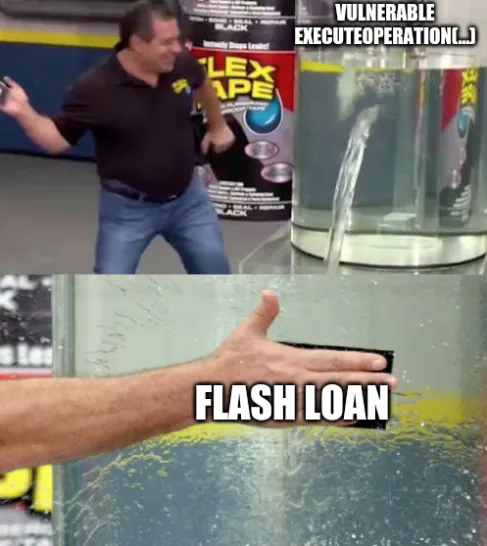

- Beyond the static analysis, the vulnerability requires significant combination of dynamic information and careful orchestration. To exploit, one needs to find clients that have still-outstanding approvals (granted to the vulnerable contract) and an active balance for the same ERC-20 token. Then one needs to retrieve the loans that the victim holds on Compound (on different currencies) and pay them off (via a flash loan or otherwise). At that point, all the victim’s funds in the ERC-20 token are available for transfer to the attacker.

For instance, the prototype victim had $2M in assets that could be acquired by paying off a $735K loan. The even larger victim had $3.7M in assets and a $1.5M outstanding loan. - Salvaging the users’ funds was highly elegant, by using precisely the flash loan and proxy authorization functionality of DeFi Saver.

Next we give some more technical detail on the above. For the service-level picture, there is a writeup by the DeFi Saver team.

Static Analysis | The Vulnerability

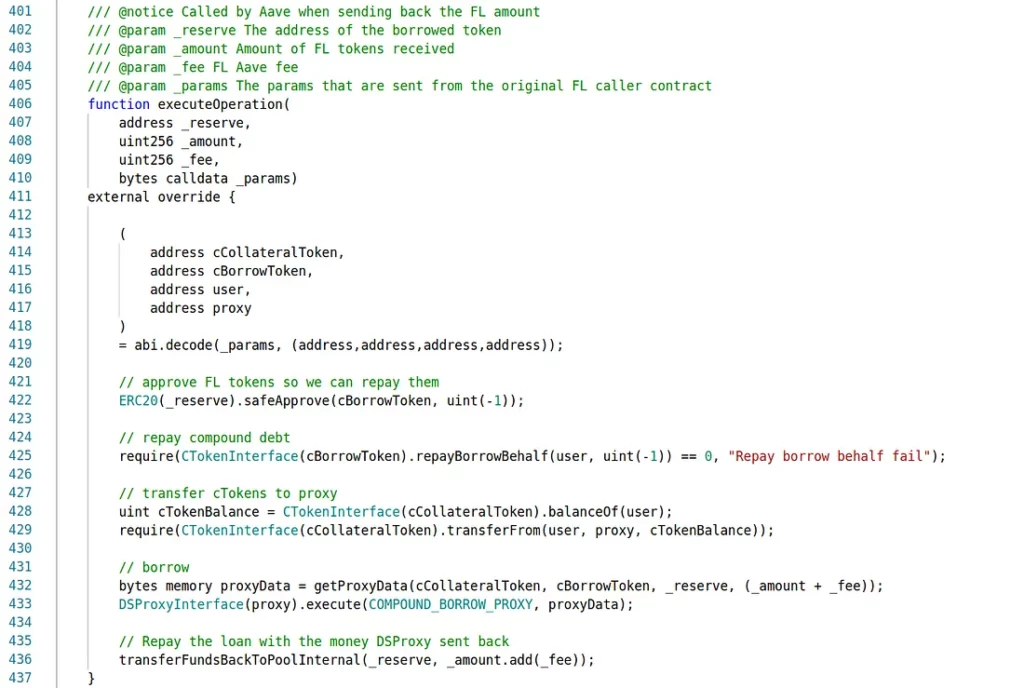

The vulnerable code could be found in two different DeFi Saver contracts. You can see the vulnerable function from one of the contracts in the snippet below:

This is helper functionality — a small, deeply-buried cog in a much larger machine. The comments reveal the intent. This is a function that gets called upon receiving an Aave flash loan, repays a Compound loan on behalf of a user, lets a caller-defined proxy execute arbitrary code, and then repays the flash loan with the money received from the proxy. However, all of this is irrelevant. “Ignore comments, debug only code” as the saying goes for the security-sensitive. And this code allows a lot more than the comments say.

Static Analysis | Automated Analysis and Finding the Vulnerability

Our main job is developing program analysis technology (including contract-library.com and the decompiler behind it). In the past half year we have started deploying a new analysis architecture that combines static analysis and symbolic execution. (We call it “symbolic value-flow analysis” and we will soon have full technical papers about it.) We found the DeFi Saver vulnerability while testing a new client for this analysis: a precise detector of “unrestricted transferFrom proxy” functionality.

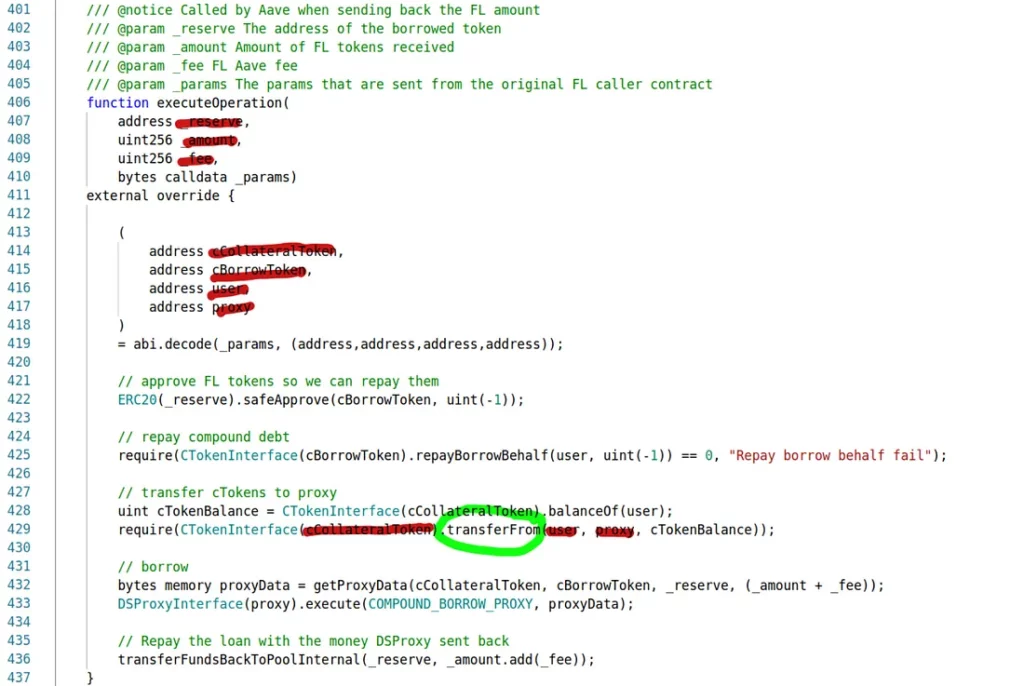

Basically, when our analysis looked at the above code, it only saw it like this:

All the red-highlighted elements are completely caller-controllable. There are few to no restrictions on what _reserve, cBorrowToken, user, proxy, etc. can be. Basically, our analysis did not see this piece of code as an “Aave callback after a flash-loan operation” but as a general-purpose lever for doing transferFrom calls on behalf of any contract unfortunate enough to have authorized the vulnerable contract.

Small tangent: You may say, this doesn’t look like it needs a very sophisticated analysis. It is pretty clear that the caller can set all these variables and they end up in sensitive positions in the transferFrom call. Indeed, even a naive static analysis would flag this instance. What made our symbolic-value flow analysis useful was not that it captured this instance but that it avoided warning about others that were not vulnerable. The analysis gave us just 27 warnings about such vulnerabilities out of the 40 thousand most-recently deployed contracts! This is an incredibly precise analysis and most of these warnings were correct (although typically no tokens were at risk).

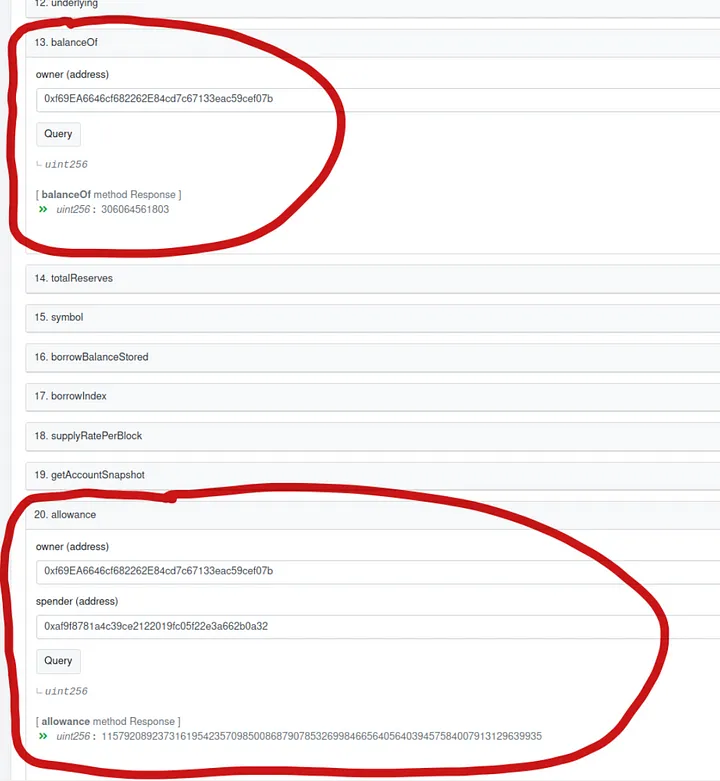

Back to the vulnerability: Finding a transferFrom statically does not imply an exploitable vulnerability. (If it did, we would have tens more vulnerabilities in our hands — the analysis issued 27 reports, as we mentioned, and most were correct.) Indeed, to perform the transferFrom there are three more dynamic requirements, based on the current state of the contracts. First, the vulnerable contract needs to have a current allowance to transfer the tokens of a victim. Second, the victim needs to have tokens. As it turns out, users of the DeFi Saver service were in exactly that state relative to the vulnerable contract. Our prototype victim shows both a balance and an allowance for the vulnerable contract:

The victim has (at the moment of the snapshot) some $2M in underlying assets (in the cWBTC coin). So, since we can do an uncontrolled transferFrom we can get all of that, right? Well, not quite. The transferFrom on a Compound CToken goes through the Compound Comptroller service, which checks the outstanding loans over the underlying assets. If the transferFrom would make the account liquidity negative, it is not allowed. Our prototype victim indeed has outstanding Compound loans — this is in fact the reason they are in this state of balances and allowances.

The victim has $2M in assets and $735K in outstanding loans. So, could we just ask for less money and do the transferFrom? Actually, no. If you check the vulnerable code from before, the last parameter, cTokenBalance, of the transferFrom is not caller-controllable! It is instead the full balance of the victim.

This brings us to the third dynamic requirement for exploiting the vulnerability. In order to call this transferFrom and get the victim’s assets, we first need to pay off their loans!

This exploit is precisely what we demonstrated to the DeFi Saver team upon disclosing the vulnerability.

The Salvage Operation

Our prototype exploit ran on a private fork of the blockchain. For the real salvaging operation, we collaborated with the DeFi Saver team. Once we discussed the plan, they took the lead in the implementation.

The salvage operation was a thing of beauty, if we may say so. The DeFi Saver team performed it very professionally, with simpler code than our original exploit. The very same vulnerable functionality (the “cog”) was used after a flash loan in order to empty the victims’ accounts and transfer the vulnerable funds to new accounts that were then assigned to the original owner.

[Relevant transactions for the two victims with the largest holdings here and here.]

Part of the elegance of the solution was that, in the end, the owners of the victim contracts held exactly the same positions as before, only now in two contracts instead of one. They had as much in underlying assets as before, and exactly as much in outstanding loans as before.

Wrapping Up

This was a very interesting vulnerability to us, although the root cause was simple (insufficient protection against hostile callers). It has many of the elements that we think are going to be central in future vulnerability detection work:

- Combinations of static and dynamic analysis to find the vulnerable instance. Human eyes cannot be inspecting all code in great depth, even when the stakes are so high. A mundane piece of functionality can be security-critical. Static analysis is essential. Yet it’s not enough. The results will have to be cross-referenced with the current dynamic state to see if the contract is actually used in a vulnerable manner.

- Future vulnerabilities may often follow the pattern of using existing pieces of code in unexpected ways. The more this happens, the more exploit generation will need to take current state into account. In this case, to exploit a contract, the attacker needs to pay off the contract’s loans. In the DeFi space, understanding of such state constraints will be crucial for future security work.

PS. If we might have saved you funds and/or you want to show support for our security efforts, we’ll be happy to receive donations at 0xACcE1553C83185a293e8B4865307aF8309af9407 .