Smart Contract Audit Essentials: Navigating the Web 3 Landscape with Expertise and Security

With blockchain platforms, Smart Contract Audits play a critical role in ensuring the security and reliability of decentralized applications. These audits are routine checks and an indispensable part of the development process, safeguarding all transactions and agreements that define the blockchain ecosystem.

Smart Contracts, with their immutable and autonomous nature, demand absolute precision in their code. Any oversight or vulnerability can lead to significant financial losses or erode trust in the technology.

At Dedaub, we blend academic thoroughness with a hacker’s practical acumen to delve deep into Smart Contract code. The main goal of a Smart Contract Audit is to eliminate faults. Our approach is to understand the intricacies of each contract and its potential pitfalls, to provide solutions that fortify its foundation.

To date, we have conducted over 200 rigorous audits for leading blockchain protocols and safeguarded billions in Total Value Locked (TVL).

Leading blockchain clients such as the Ethereum Foundation, Chainlink, and Coinbase have placed their trust in us, not just for our ability to spot vulnerabilities but for our commitment to elevating the standards of blockchain security.

The Critical Role of Audits in Blockchain Security

At its core, a Smart Contract Audit is a meticulous process where experts scrutinize the code of a blockchain Smart Contract (SC) to identify vulnerabilities, inefficiencies, and potential exploits.

The systematic examination of Smart Contract Audits is crucial in the blockchain domain, where SCs play a pivotal role in automating, verifying, and enforcing the terms of a digital contract. This is essential when using blockchain technology because transactions are irreversible, making the accuracy and security of SCs essential.

Smart Contract Audits combine automated tools with expert reviews. The process starts with thoroughly analyzing the contract’s design and architecture. It continues with a detailed line-by-line code examination to uncover hidden issues.

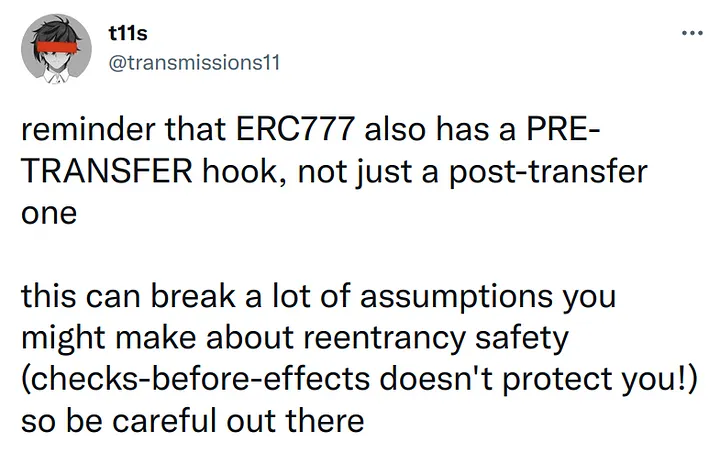

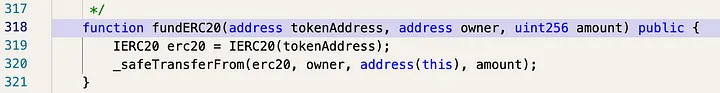

Auditors look for common vulnerabilities like reentrancy attacks, overflow/underflow issues, gas limit problems, and more nuanced logic errors that could compromise the contract’s functionality.

Dedaub is a reliable partner with expertise and dedication to excellence. We specialize in ensuring that Smart Contracts adhere to the highest security and reliability standards, regardless of the protocol used.

The Dedaub Audit Methodology

At Dedaub, each of our Smart Contract Audits is a meticulously crafted process. Each one uniquely combines academic precision with practical hacking insights. This comprehensive approach is structured into five stages, ensuring a thorough and effective audit tailored to each project’s needs.

Stage 1: Cost and Schedule Proposal

Our process begins with carefully assessing the Smart Contract’s codebase, considering its scope and complexity. We formulate a cost-effective proposal and a realistic timeline that aligns with your project’s deadlines and budget constraints. This initial stage sets the groundwork for a well-organized audit process.

Stage 2: Audit Commencement

In the second stage, our experts dedicate the agreed time to analyze your Smart Contract thoroughly. This phase includes ongoing interaction with your development team. This fosters a collaborative and efficient audit, where we examine every aspect of the Smart Contracts to identify potential vulnerabilities.

Stage 3: Preliminary Findings Delivery

We then categorize and detail the findings in a preliminary report, classifying them by risk level: Critical, High, Medium, Low, or Advisory. A discussion session with your team is held at this stage to clarify any issues and set the groundwork for the next improvement steps.

Stage 4: Issue Resolution Process

At this stage, your developers work to address the identified issues, guided by our tailored advice provided in the initial report. This collaborative approach ensures the effective implementation of solutions to enhance the contract’s security and functionality.

Stage 5: Final Review and Report

In the final stage, we conduct a comprehensive post-mitigation review to confirm the resolution of all issues. The process culminates with a detailed final report documenting the entire audit process and its outcomes. This results in a clear roadmap for ongoing Smart Contract security.

Dedaub’s audit methodology is designed to ensure precise and practical auditing of Smart Contracts. Our approach helps to enhance the security of blockchain projects by effectively identifying and addressing potential vulnerabilities.

Case Studies

We work for the Ethereum Foundation on complex studies such as Ethereum Improvement Proposals (EIPs) EIP-4878, EIP 6404, EIP 6466, EIP 4758 and EIP 6780.

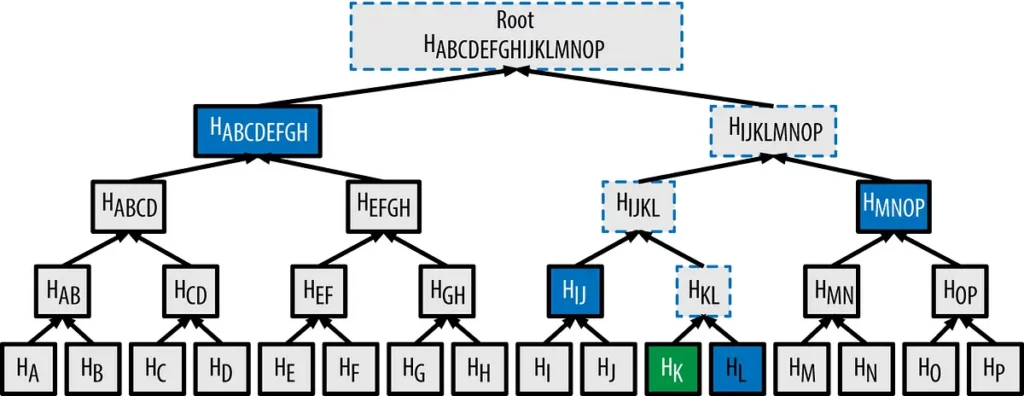

The EIP 6404 and EIP 6466 is a study to assess the potential impact of Ethereum Improvement Proposals (EIPs) 6404 and 6466. In a project commissioned by the Ethereum Foundation, Dedaub undertook an extensive study to assess the potential impact of Ethereum Improvement Proposals (EIPs) 6404 and 6466.

These EIPs proposed significant modifications to the Ethereum network, particularly in the serialization algorithm for transactions and receipts. This shift involved moving from the Recursive Length Prefix (RLP) format to the Simple Serialize (SSZ) format.

This change directly impacted the Receipts Root and Transactions Root fields in the execution layer headers, presenting a complex challenge for existing Smart Contracts on the Ethereum mainnet.

The Challenge

The primary concern was the potential disruption to contracts relying on RLP for proofs, especially those critical to decentralized bridges. These bridges play a crucial role in creating proofs about historical transaction logs.

Our objective was to quantify and qualify the extent of potential disruption and identify specific on-chain patterns verifying commitments in this new manner. This required a detailed, semi-automated examination of all Smart Contracts on the Ethereum network, analyzing their recent behavior to gauge the impact of these changes.

Our Approach

We analyzed various Smart Contracts, identifying those critical to projects and assessing possible mitigating actions. Our team concentrated on evaluating the impact of these changes, especially on projects involving cross-chain bridges, and considered both on-chain solutions like upgrades and off-chain strategies like modifying oracles.

Findings and Impact

Our study revealed that the changes proposed in the EIPs notably affected a handful of projects, predominantly cross-chain bridges. Some of the key projects impacted included:

- zkBridge (https://zkbridge.com): Moderate Impact

- LayerZero (https://layerzero.network/): Moderate Impact

- Telepathy (https://docs.telepathy.xyz/): Moderate Impact

Interestingly, our findings showed that out of the two proposed EIPs, only EIP-6466 (Receipts Root EIP) significantly impacted the inspected protocols. This was due to its effect on log-inclusion proofs, a common method for conducting cross-chain message passing.

Why Choose Dedaub for Smart Contract Audits?

If you’re looking to get a Smart Contract audit for your blockchain project, choosing the right partner is important. Dedaub is a reliable and trustworthy choice in this regard, not just because of our technical expertise but also because of the values we stand for – integrity, innovation, and the empowerment of blockchain talent. Our approach is rooted in these core values, directly translating into our high-quality audits.

Integrity in Every Audit

At Dedaub, integrity is at the forefront of everything we do. This means conducting audits with the utmost honesty, thoroughness, and transparency. Our clients’ trust in us is integral to their success.

Our commitment to integrity ensures that every audit is conducted with meticulous attention to detail, offering our clients a true and complete assessment of their Smart Contract’s security.

Pioneering Innovation

Innovation is key in the rapidly evolving blockchain landscape. Our team constantly explores the latest advancements in blockchain technology and Smart Contract development. This pursuit of innovation enables us to provide cutting-edge solutions to our clients, ensuring their Smart Contracts are resilient against current and future security threats.

Empowering Blockchain Talent

We believe in empowering the next generation of blockchain professionals. Through our Smart Contract Audits, we secure our clients’ projects and share knowledge and insights that contribute to the overall growth of the blockchain community.

By educating and nurturing talent, we’re helping to build a more secure and robust blockchain ecosystem.

These core values of Dedaub translate into a thorough and forward-thinking audit service that contributes positively to the broader blockchain community. Choosing Dedaub means partnering with a team that is deeply invested in the success and security of your project, as well as the advancement of the entire blockchain industry.

The Future of Smart Contract Audits, Embracing ZK Audits and Beyond

The landscape of Smart Contract Auditing is constantly evolving and is being influenced by groundbreaking trends and innovations. One of these trends is the emergence of Zero-Knowledge (ZK) proofs, a pivotal technology that is reshaping how audits are conducted. At Dedaub, we are always at the forefront of these advancements and are integrating them to offer more robust and sophisticated audit services.

Our team has a combination of cryptography expertise and hands-on knowledge of ZK-proof systems and technologies. Our auditors invest significant time in continuous education on foundational knowledge and applied knowledge, with a recent emphasis on the domain of zero-knowledge proofs.

Conclusion

The significance of Smart Contract Audits in fortifying the Web3 ecosystem cannot be overstated. As the digital landscape evolves, these audits form the backbone of trust and security, ensuring blockchain technologies function as intended and uphold the highest standards of reliability and integrity.

Dedaub, with our unique blend of academic rigor and practical expertise, stands as a vanguard in this field. We offer comprehensive audits that safeguard against vulnerabilities and fortify the foundations of decentralized applications.

We invite you to leverage our extensive experience and expertise. Contact us at Dedaub to discuss how we can elevate the security and performance of your Smart Contracts, paving the way for a safer, more robust Web3 future.